- The Financial Landscape of Hawaii

- Choosing Your Island Wisely

- Finding Affordable Shelter: A Creative Approach

- Mastering Food Costs: Smart Shopping and Cooking

- Navigating Transportation Costs: Embracing Alternatives

- Minimizing Utility Costs: Conservation is Key

- Healthcare on a Budget: Exploring Options

- Free and Low-Cost Activities: Enjoying Paradise Without Spending Much

- Generating Income: Part-Time Work and Remote Opportunities

- Embracing Minimalism and Resourcefulness

- Conclusion

The dream of Hawaii, with its stunning natural beauty and relaxed island vibe, often feels financially out of reach for many. The common perception is that living in this tropical paradise requires a substantial income. While it's true that the cost of living in Hawaii is generally high, the idea of calling this enchanting place home on a budget of $1,000 per month, though incredibly challenging, is not entirely impossible for those who are exceptionally dedicated and resourceful. This guide aims to explore the potential pathways, however narrow, that might lead to a life amidst Hawaii's splendor without emptying your wallet.

The Financial Landscape of Hawaii

It's crucial to first understand the financial realities of living in Hawaii. It's an expensive state, and for an individual to live comfortably, an annual income between $70,000 and $100,000 is typically recommended . Even a basic existence is estimated to require between $55,000 and $65,000 per year . With the average monthly cost of living exceeding $3,000 and Honolulu being significantly more expensive than the national average , a $1,000 monthly budget, which translates to just $12,000 annually, presents a significant hurdle. Succeeding on such a limited income demands a radical lifestyle adjustment and an unwavering commitment to extreme frugality. This journey will likely involve considerable compromises and a constant need for resourcefulness, requiring adaptation in ways that might feel unconventional . However, for those who are willing to embrace simplicity and actively seek out every possible cost-saving opportunity, this guide will delve into the strategies that offer a glimmer of hope for making the $1,000 Hawaiian dream a reality.

Choosing Your Island Wisely

The first critical decision in this ambitious endeavor is selecting the right Hawaiian island. Not all islands are equally affordable. The Big Island consistently emerges as the most budget-friendly option for those looking to buy property . Within the Big Island, the Hilo area stands out as particularly affordable, recognized as the most affordable region in the entire state for prospective homeowners and identified as one of the most affordable places to reside in 2025 . The cost of living in Hilo is reported to be lower than that of Honolulu and Maui , with some estimates placing it as much as 28% below the overall state average . This makes the Big Island, with a strong focus on Hilo, the most promising starting point for anyone attempting to live in Hawaii on a $1,000 monthly budget.

While the Big Island offers the most compelling affordability, other islands present potential pockets of relative cost-effectiveness. Waianae, situated on the western coast of Oahu, is frequently mentioned as a more budget-conscious area , boasting lower housing costs compared to Honolulu and an overall cost of living approximately 11% lower than the state average . Other areas that occasionally appear on lists of more affordable Hawaiian locales include Kahuku, located on Oahu's northern tip, Pahoa, also on the Big Island, and the remote island of Kaunakakai on Molokai . However, it's important to recognize that choosing a more affordable location often involves accepting certain trade-offs. These areas might be more geographically isolated, offer fewer job opportunities, or lack the extensive amenities found in more populated centers like Honolulu . For example, while Kaunakakai on Molokai boasts significantly lower living costs, it also implies a lifestyle that is considerably more "off the grid" , which might not suit everyone's needs or preferences. Therefore, while exploring these alternative locations is worthwhile, the Big Island, particularly Hilo, presents the most robust case for attempting to live on such a limited budget due to its consistently lower overall expenses.

Finding Affordable Shelter: A Creative Approach

Securing affordable shelter is paramount when operating on a $1,000 monthly budget, especially in a state where housing costs are notoriously high. Traditional rental options in Hawaii are generally out of reach for this budget. A typical one-bedroom apartment can cost anywhere from $1,600 to $3,000 per month , and even outside the bustling center of Honolulu, the average rent for a one-bedroom unit hovers around $1,873 . These figures far exceed the entire $1,000 budget, making it clear that conventional renting is not a viable path. Instead, individuals must explore highly creative and deeply discounted housing alternatives.

One essential strategy is to seek out shared housing arrangements. Research indicates that finding rentals without roommates is exceedingly difficult . By sharing an apartment or house with others, the cost of rent and utilities can be significantly reduced. While even a room rental in Hawaii can be expensive, focusing on less popular or more remote areas of the Big Island or in Waianae on Oahu might yield more budget-friendly options . Online platforms and local community boards can be valuable resources for finding roommate situations.

Another avenue to explore is long-term stays in hostels. Hostels in Hilo on the Big Island offer some of the most affordable nightly rates, starting as low as $10 . Weekly rates at hostels like Howzit Hostels Hawaii in Hilo are reported around $64 and up , with other Hilo hostels potentially offering weekly rates around $116 . On Oahu, Haleiwa has hostel options with weekly stays around $119 , while even in Waikiki, known for its high costs, weekly dorm stays can be found for around $285 . Opting for a dorm bed in a hostel, particularly in a more affordable location like Hilo, could potentially fit within a very tight budget, especially if monthly discounts are negotiated directly with the hostel management . While this option offers minimal privacy and shared facilities, it can provide a significantly cheaper alternative to traditional rentals. Direct contact with hostels in Hilo and other affordable areas to inquire about long-term monthly rates is a crucial step .

Work exchange programs offer another compelling solution for drastically reducing housing costs. Platforms like Worldpackers list numerous opportunities across Hawaii , including specific listings near Hilo and in Pahoa on the Big Island. While specific information for Waianae on Oahu wasn't available in the provided snippets, such opportunities might also exist there. These programs typically provide free accommodation, and sometimes even meals, in exchange for a set number of work hours per week. The work can range from tasks in hospitality, such as housekeeping or reception, to roles in farming, eco-projects, or community initiatives . For someone on a $1,000 budget, being willing to exchange their labor for housing can be a game-changer, effectively reducing their accommodation costs to almost zero. Exploring the Worldpackers website and similar platforms for opportunities in the more affordable regions of Hawaii is a vital step.

While not explicitly mentioned in the provided materials, seeking caretaking or house-sitting positions could also offer very low-cost housing options. These roles typically involve looking after someone's property or pets while they are away, often in exchange for free accommodation and sometimes a small stipend. Local networks, community bulletin boards, and specialized online platforms can be resources for finding these types of opportunities in Hawaii.

Finally, a willingness to live in less popular or more remote areas is key to finding cheaper housing. Properties located near beaches and in popular tourist destinations command premium prices . By focusing on more rural or less developed areas, such as the Puna or Mountain View districts on the Big Island , or the Waianae or Kahuku areas on Oahu , individuals can significantly increase their chances of finding more affordable housing options, even if it means accepting a longer commute or fewer nearby amenities.

Mastering Food Costs: Smart Shopping and Cooking

To make a $1,000 monthly budget work in Hawaii, meticulous attention must be paid to food expenses. Grocery costs in Hawaii are generally higher than on the mainland due to the islands' remote location and reliance on imports . However, by employing smart shopping strategies, it is possible to nourish oneself without breaking the bank.

Prioritizing shopping at budget-friendly retailers is essential. Costco and Walmart are consistently highlighted as the most affordable grocery stores in Hawaii . Don Quijote is also recommended as a source of affordable and diverse groceries . For those with a Costco membership and sufficient storage space, buying in bulk can lead to significant savings on non-perishable items .

Many Hawaiian grocery chains, including Foodland and Safeway, offer loyalty programs that provide discounts and special offers to members . Signing up for these programs and actively using the associated cards or apps can result in noticeable savings over time.

Local farmers markets and People's Open Markets are invaluable resources for accessing more affordable and often fresher produce . Farmers markets across the islands offer a variety of locally grown fruits, vegetables, and other agricultural products . On Oahu, the People's Open Markets are specifically designed to provide low-cost produce, often at prices significantly below those found in retail stores . The Hilo Farmers Market on the Big Island is also known for its affordable prices and wide selection of local goods , as are the various Puna Farmers Markets . Regularly visiting these markets and being flexible with meal planning based on seasonal availability and market specials can help stretch a limited food budget.

Given the high cost of eating out , preparing all meals at home is a non-negotiable strategy for living on $1,000 a month in Hawaii. Restaurant meals can easily cost $40 or more for two people at local establishments and significantly more at upscale venues . Focusing on cooking simple, affordable meals using staples like rice, beans, eggs, and in-season produce purchased from budget-friendly stores and farmers markets is crucial. Cooking in bulk and utilizing leftovers can also help maximize food savings.

For those committed to extreme frugality, exploring opportunities for safe and legal foraging for edible plants or fruits in their local area might be an option to supplement their diet. Additionally, researching and potentially participating in local food banks, community gardens, or food sharing initiatives could provide access to additional food resources at little to no cost.

Navigating Transportation Costs: Embracing Alternatives

Navigating transportation costs is another critical aspect of living in Hawaii on a tight budget. Owning and maintaining a vehicle can be prohibitively expensive, with high costs for gas, insurance (ranging from $150 to $200 monthly ), and registration. Therefore, relying on alternative modes of transportation is essential.

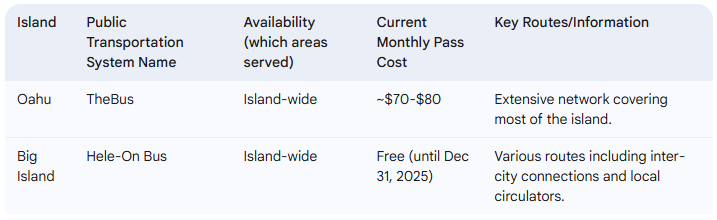

Fortunately, both Oahu and the Big Island, the most frequently cited affordable islands, have public transportation systems. Oahu boasts an extensive bus network known as TheBus , with a monthly pass costing approximately $70-$80 . This allows for island-wide travel, making it a viable option for commuting and accessing services.

Remarkably, the Big Island's public transportation system, the Hele-On Bus , is currently offering free fares for all commuter and local fixed routes until December 31, 2025 . This presents a significant financial advantage for anyone living on the Big Island, as transportation costs can be virtually eliminated. Should fares be reinstated after this period, a monthly pass could potentially cost $60 for a basic pass or $45 for a discount pass .

For shorter distances and in areas with suitable infrastructure, biking and walking can serve as free and healthy transportation alternatives . Waianae on Oahu has some bike trails and paths , and many areas across the islands offer numerous walking and hiking trails . If feasible, bringing a bicycle or purchasing an affordable used one upon arrival can further enhance mobility without incurring significant costs. Choosing a living location that is within reasonable biking or walking distance of essential services can also reduce the need for frequent bus travel.

Minimizing Utility Costs: Conservation is Key

Managing utility costs is another crucial aspect of living affordably in Hawaii. Electricity costs in particular are among the highest in the United States , with average monthly bills ranging from $160 to $400 depending on air conditioning usage , and even averaging around $393.87 . Water, internet, and phone services also contribute to monthly expenses .

To keep these costs down, diligent conservation is essential . Numerous practical tips can help minimize consumption, such as using fans instead of air conditioning whenever possible , shortening showers , washing clothes in cold water and air-drying them , air-drying dishes , unplugging electronic devices when not in use , and promptly fixing any leaky faucets . Utilizing LED lighting throughout the living space can also significantly reduce electricity consumption . Being mindful of refrigerator and water heater usage, such as keeping refrigerator temperatures within the recommended range and using timers for water heaters , can further contribute to savings.

While potentially requiring an initial investment, exploring options for small-scale solar power, if feasible within the chosen living arrangement (especially for longer-term stays or if renting allows), could lead to long-term savings on electricity bills . However, for many on a tight budget, the immediate focus will be on minimizing consumption through behavioral changes and low-cost efficiency measures. Even with strict conservation efforts, utility costs, particularly electricity, will likely constitute a significant portion of the $1,000 budget, underscoring the importance of diligent management.

Healthcare on a Budget: Exploring Options

Access to healthcare is a fundamental need, and finding affordable options is crucial for those living on a limited income in Hawaii. Exploring eligibility for Medicaid, known as Med-QUEST in Hawaii, should be a priority . Med-QUEST is a state and federal program that provides access to health insurance for low-income individuals and families . Single individuals earning under approximately $24,000 per year and families of four with incomes below around $50,000 per year may qualify . Project Vision Hawaii offers assistance with the Med-QUEST application process . For someone with a very low income, qualifying for Med-QUEST could provide essential healthcare coverage at no cost.

If Medicaid eligibility is not met, understanding the costs of basic health insurance plans is necessary. The average monthly cost of health insurance in Hawaii is around $523 , although subsidies are available through the Affordable Care Act marketplace (HealthCare.gov) for individuals with incomes between roughly $17,310 and $69,240 . Kaiser Permanente often offers some of the cheapest plans, with monthly rates ranging from approximately $486 to $502 , although these plans may have restrictions on the doctors and hospitals within their network. Even with subsidies, the cost of private health insurance could still be a significant expense on a $1,000 budget, making Medicaid eligibility particularly important.

Beyond traditional insurance, exploring resources for low-cost or free healthcare services can be beneficial. Telemedicine is widely utilized in Hawaii for its convenience , and researching local community health clinics or other organizations that offer free or reduced-cost healthcare services could provide additional options for accessing necessary medical care.

Free and Low-Cost Activities: Enjoying Paradise Without Spending Much

Living in Hawaii on a tight budget doesn't mean missing out on the islands' renowned beauty and culture. Numerous free and low-cost activities are readily available . Hawaii boasts an abundance of stunning natural attractions that can be enjoyed without spending a dime. Beaches across all islands offer opportunities for swimming, sunbathing, and simply enjoying the ocean views . The Big Island, in particular, is home to unique black sand beaches like Punalu'u . Hiking enthusiasts will find a plethora of free trails, ranging from easy coastal walks to more challenging mountain treks. Waterfalls, such as the iconic Rainbow Falls on the Big Island , can be viewed for free in many locations. National and state parks, like Kaloko-Honokohau National Historical Park on the Big Island , often have minimal or no entrance fees and offer opportunities to explore historical sites and natural landscapes. In Kona, many beaches provide free, family-friendly activities .

Beyond the natural wonders, there are many budget-friendly ways to experience Hawaiian culture and explore the islands. Taking self-guided walking tours of historic areas, such as Historic Downtown Hilo or Historic Kailua Village , is a free way to learn about the islands' past. Visiting local farmers markets, beyond just grocery shopping, can be an engaging cultural experience . On the Big Island, stargazing at the Mauna Kea Visitor Information Center is a popular free activity . Checking local newspapers and community groups, such as "Hilo Puna Happenings" on Facebook , can reveal information about free public events happening at community centers, churches, schools, and other venues.

Generating Income: Part-Time Work and Remote Opportunities

To supplement a $1,000 monthly budget, exploring income-generating opportunities in Hawaii is a logical step. While finding full-time employment that allows for living on such a low budget might be challenging, part-time work can provide a much-needed financial boost . In Hilo on the Big Island, part-time jobs are available in various sectors, including tourism, retail, food service, and healthcare . Hourly rates can vary, but some positions may start around the state's minimum wage. Online job boards like Indeed and ZipRecruiter list numerous part-time opportunities in Hilo and other areas .

For individuals with the right skills, remote work offers another potential income stream . Remote job opportunities exist in fields such as customer service, technology, and sales, with companies based both in Hawaii and on the mainland . A reliable internet connection is essential for remote work, and securing this might be an additional cost to factor into the budget.

The gig economy also presents flexible earning possibilities. Services like DoorDash and Instacart offer part-time work as delivery drivers . Additionally, individuals with skills in areas like cleaning, yard work, or handyman services could offer these services locally to generate income.

Embracing Minimalism and Resourcefulness

Living in Hawaii on a $1,000 monthly budget demands a fundamental shift towards a minimalist mindset. Extreme frugality must be applied to every aspect of life. Careful budgeting and meticulous tracking of expenses are not just recommended but essential. Embracing resourcefulness and adopting a do-it-yourself (DIY) approach to repairs, clothing alterations, and other needs can yield significant savings. Exploring opportunities for bartering goods or services within the local community or participating in local sharing economies for things like tools or transportation could further help to stretch the limited budget.

Conclusion

While living in Hawaii on a mere $1,000 per month presents an extraordinary challenge, it is not entirely impossible for those willing to embrace a highly unconventional and extremely frugal lifestyle. The key strategies involve choosing the most affordable island, the Big Island (particularly the Hilo area), prioritizing deeply discounted housing options like work exchange programs or long-term hostel stays, maximizing savings on food through strategic shopping at budget retailers and farmers markets, utilizing the free public transportation on the Big Island (at least until the end of 2025), diligently conserving utilities, exploring eligibility for Medicaid, and taking full advantage of the numerous free natural attractions and low-cost community activities. Supplementing the budget with part-time work or remote income is also a critical component. It requires unwavering commitment, resourcefulness, and a deep appreciation for the simple pleasures of island life, but for the truly dedicated, paradise on pennies might just be within reach.

Sources:

Living in Hawaii: https://www.livinginhawaii.com/cost-of-living-in-hawaii-2024/

Real Hawaii: https://realhawaii.co/blog/cost-of-living-hawaii

NerdWallet: https://www.nerdwallet.com/cost-of-living-calculator/city-life/honolulu-hi

Sofi: https://www.sofi.com/best-affordable-places-to-live-in-hawaii/

Extra Space Storage: https://www.extraspace.com/blog/city-guides/most-affordable-places-to-live-in-hawaii/

Royal Hawaiian Movers: https://www.royalhawaiianmovers.com/cheapest-places-to-live-in-hawaii/

Payscale: https://www.payscale.com/cost-of-living-calculator/Hawaii-Honolulu

Moving Waldo: https://www.movingwaldo.com/where-to-live/cost-of-living-hawaii/

Schmidt Movers: https://www.schmidtmovers.com/2020/09/08/cheapest-places-to-live-in-hawaii/

Houzeo: https://www.houzeo.com/blog/cheapest-places-to-live-in-hawaii/